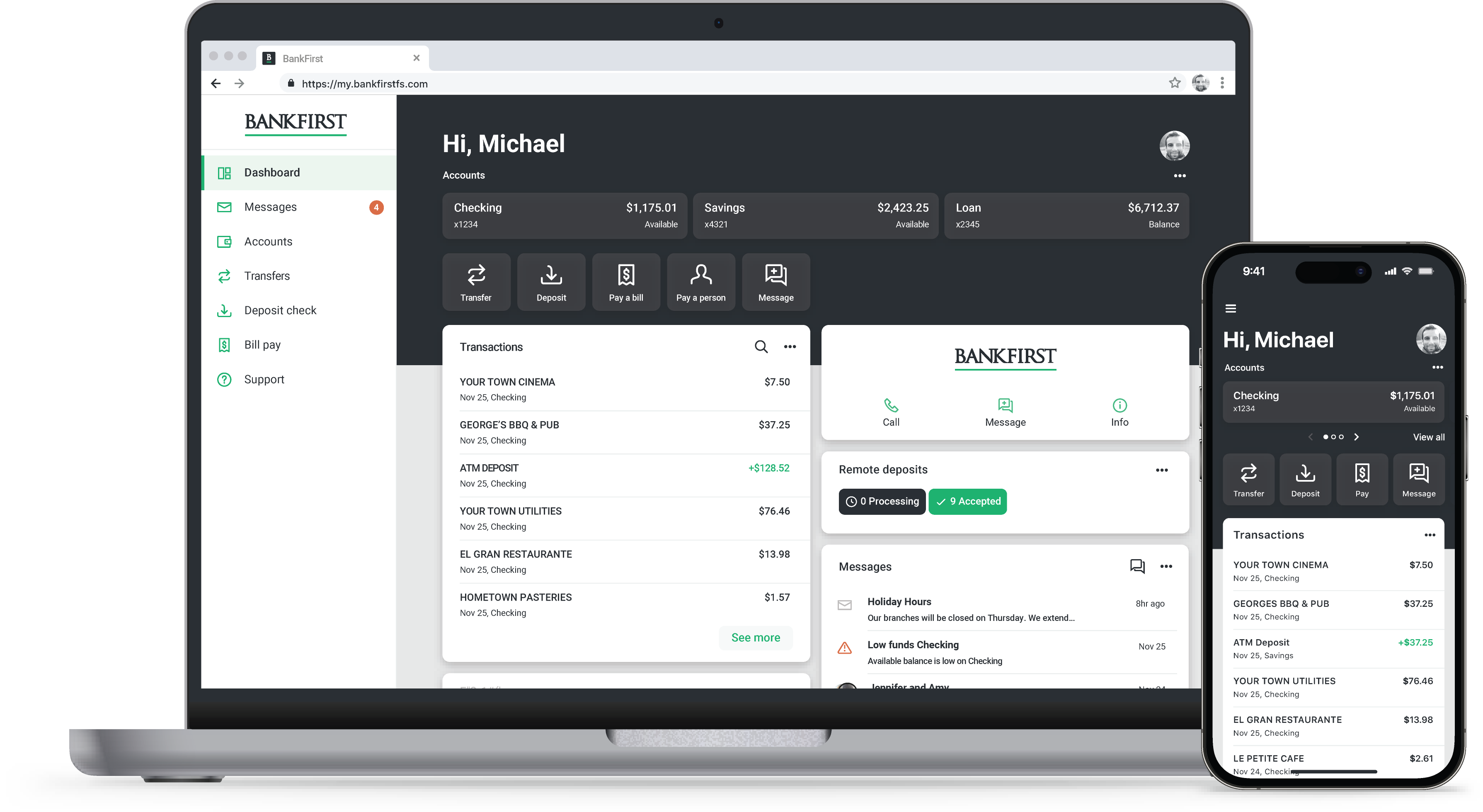

Securely view balances, transfer funds, and more—all from the comfort of home—with Online and Mobile Banking.

All the Tools You Need

At Home, at Work, or On the-Go

View Balances

View Balances

View all of your BankFirst account balances in one, centralized location.

Deposit Checks

Deposit Checks

Deposit checks anytime, anywhere, using your mobile phone's camera.

Transfer Funds

Transfer Funds

Transfer funds between accounts (one-time and recurring transfers)

Customize Dashboard

Customize Dashboard

Select preferred accounts and features, allowing you to easily monitor account balances and transactions.

Card Controls

Card Controls

Conveniently toggle your debit card on or off, report it as lost or stolen, and request or activate a new card.

Tagging

Tagging

Efficiently categorize transactions by adding notes, photos, and labels for simplified organization and swift searches.

Alerts

Alerts

Stay informed by setting up alerts that notify you of fluctuations in your balances.

Travel Notices

Travel Notices

Easily pre-inform the bank your travel details from your desktop or mobile app.

Electronic Statements

Set up and manage Electronic Statements (eStatements) directly using Online & Mobile Banking.

Stop by to Get Started

BankFirst uses a single app for both personal and business accounts. Select the store below to download the single app.

Stop by one of the BankFirst locations to enroll, and take control of your banking experience with Online & Mobile Banking.

Free, secure, and easy-to-use

Anywhere Banking Tools

BankFirst Online & Mobile Banking comes with all the digital banking tools you'll need to bank from virtually anywhere.

If your access to the Digital Banking Services (BankFirst Online Banking) is terminated by you or the bank for any reason, please be aware that you will no longer receive electronic periodic account and activity statements concerning your Accounts, regardless of whether you may have previously consented to receiving such documents electronically (Online Statements or E-Statements). Instead, upon termination of the Digital Banking Services, any and all periodic account and activity statements will be provided to you in mailed paper form and your Accounts will be assessed the applicable fees for receiving Paper Statements as set in your fee schedule and Truth-In-Savings Disclosure and listed below.

Paper Statement Fee — varies from $2.00–$5.00

The Paper Statement Fee varies by account type and does not apply to all accounts. The Paper Statement Fee is $2.00 per account, per statement for the following account types: Basic Checking, Private Client Checking and Money Market accounts. The Paper Statement Fee is $5.00 per account, per statement for the following account types: Cash Back Checking, Interest Checking and all commercial checking account types with the exception of Money Market accounts which are $2.00 per account, per statement.